How To Check If A Norwegian Bank Is Credible Online?

The use of online banking is prevalent in Norway. In 2019, 95 percent of respondents reported using the internet for online banking, rising to 97 percent among recent internet users. So, only digitally-focused banks will thrive in the country. However, due to the lack of personal interaction between the bank and the customer, online banking raises the possibility of fraudulent activity and identity theft. It is vital to check the credibility of a bank online before making any transactions. Online banking is vulnerable to security breaches and fraud, so it is crucial to ensure that the bank is legitimate and trustworthy. Norwegian finance company reviews matter in this regard if you want to find the best bank possible. Lastly, if you want to open a bank account in Norway, look for these features to determine credibility.

Verify Certification On the Website

Most Norwegian banks have received accreditation from the Norwegian Financial Supervisory Authority and the European Banking Authority, two of the world’s foremost financial regulatory bodies. Financial institutions will list their qualifications and accreditations on their official website. Most websites’ “About Us” or “Security” sections will have this data. So whatever your purpose for opening a bank account, be it getting medical insurance in Norway, or applying for a loan, make sure to verify the certifications.

Check Online Reviews

Previous customers’ opinions on the bank’s reliability and service quality are invaluable. For in-depth understanding, research Norwegian online reviews and see what the locals have to say about different banks.

Credit Score Of The Bank

Credit rating agencies such as Moody’s, Fitch, and Standard & Poor’s assign ratings to financial institutions like banks to assist investors in determining the risk associated with investing in those institutions.

Call The Bank

Make direct contact with the bank. Have a conversation with a bank’s customer service team member to obtain additional information regarding the bank’s services, fees, and other specifics.

Consult A Financial Pro.

A seasoned and well-informed financial adviser can provide helpful information regarding the credibility of the bank and any other aspects that need to be considered.

Verify The Corporate Id.

Every Norwegian limited company has a company number. This number and the company’s location must be on its website. Depending on the situation, this could be in a company’s terms and conditions or privacy policy.

Examine The WHOIS Registry.

Using the website www.who.is, you can verify a company’s address and contact person by checking who the domain name registrant is. The website will tell you when the domain name was registered, which helps determine the website’s age. It may be a red flag that the company has developed it or that the registrant’s information is obscure.

Conclusion

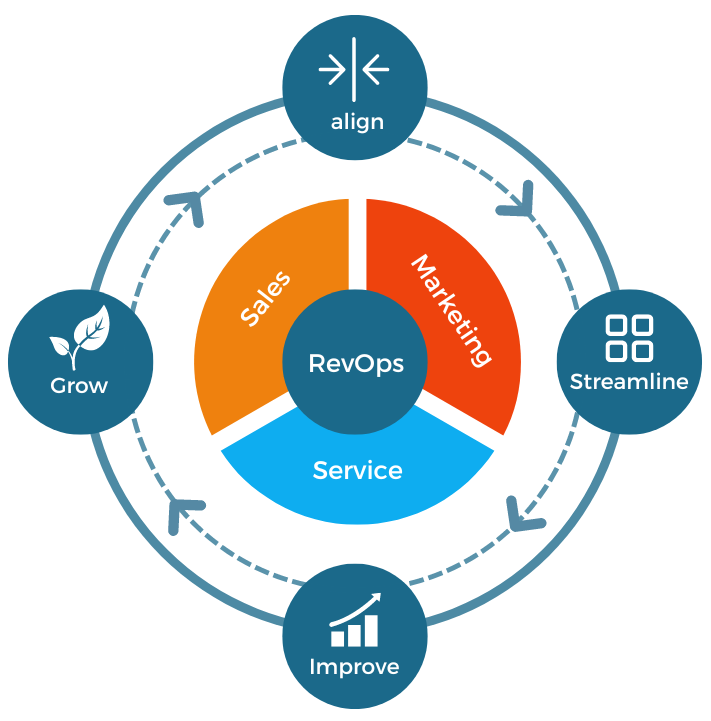

Neobanks are welcome in Norway because of the country’s progressive attitude towards digital finance and the widespread acceptance of new forms of digital payment among the population.

Even if you’ve taken every precaution to ensure that the bank you’re dealing with is reputable, you should always trust your gut. Don’t do business with a bank with whom you sense any uneasiness. SMEs frequently face the adverse effects of fraud, but the more cautious their owners are, the better their chances of avoiding it. You must always do homework on prospective clients and vendors to avoid doing business with scams.

.jpeg?width=682&height=455&name=AdobeStock_295048993%20(1).jpeg)