Is ContextLogic A Good Ecommerce Stock Investment?

[ad_1]

alexsl

ContextLogic (NASDAQ:Desire) is an ecommerce company recognized for its Desire buying system. The app took off in acceptance all through the top of the pandemic. Men and women that have been caught at house embraced Wish’s differentiated “treasure hunt” fashion of discount-procuring for distinctive or unforeseen things.

Given that early 2021, nevertheless, matters have gone painfully mistaken for both of those ContextLogic as a enterprise and Desire as a inventory. Shares are down additional than 90% from the peak, and the firm’s economical benefits are also a mess. What is absent improper for the ecommerce website, and is there significantly hope of a turnaround?

Want Inventory Essential Metrics

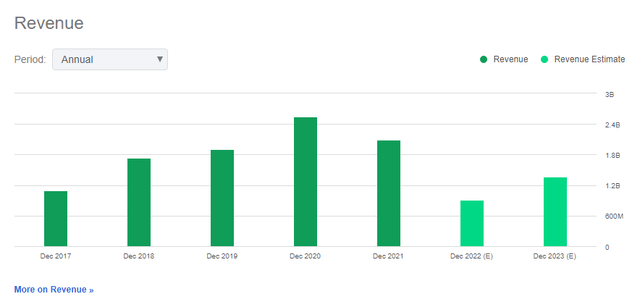

There is a person crucial metric for ContextLogic that must highlight this company’s issues correct from the leap. It truly is the firm’s leading-line sales:

Would like revenues (Searching for Alpha)

After hitting a peak of $2.5 billion in 2020, the company’s revenues tumbled to $2.1 billion previous calendar year. And then, items received definitely lousy. For 2022, analysts now assume the organization to deliver a mere $907 million of revenues. That’s down by a lot more than fifty percent as opposed to 2021 and off by in the vicinity of two-thirds due to the fact the 2020 peak.

So, let us be distinct: ContextLogic isn’t really just a further ecommerce organization that is observing a post-pandemic slowdown. Fairly, ContextLogic is a enterprise that at this time has a broken organization design and demands to wholly reinvent by itself if it is heading to deliver shareholder benefit likely ahead.

The company’s base line will not search substantially better. It can be never created a favourable operating money on an once-a-year foundation. And, even though the organization has cut prices not too long ago, it has not been practically sufficient to preserve up with plunging revenues. Analysts count on the enterprise to eliminate 57 cents for every share in 2022, 47 cents in 2023, and produce an additional 31-cent decline in 2024.

Offered that the company’s inventory is buying and selling at significantly less than $2/share now, these are alarmingly massive earnings per share losses that are becoming forecast likely ahead.

Is ContextLogic Stock Undervalued?

On the foundation of the above metrics, I might argue that ContextLogic stock is overvalued, if something. The corporation has produced an functioning loss of at least $144 million per year just about every of the previous five several years. Often, individuals losses have been a great deal greater, with operations burning by extra than fifty percent a billion pounds in 2020 alone.

These big losses seemingly haven’t generated a significant recurring income base or solid manufacturer that presents the company anything to tumble again on. Despite investing all this money mainly in advertising, the second market disorders turned in 2021, WISH’s functioning final results plummeted.

You could argue purely on a sector cap basis that shares may well be undervalued in a single perception. The company is still likely to do about a billion in revenues this year and the sector cap is just barely above that figure. 1x sales is not a demanding valuation for an on the internet retailer. Or, ordinarily, it would not be. In the circumstance of ContextLogic, on the other hand, individuals revenues are plunging and there is certainly small proof that the corporation will be equipped to transform alone all over in the intermediate foreseeable future.

How Does Wish Inventory Review To Other Ecommerce Opponents?

From my comprehending, the significant variation concerning Want and more substantial ecommerce players is that Want has focused on a specialized niche fairly than broad-based attraction. Contrary to, say, Amazon (AMZN), you will not go on Wish to obtain anything less than the sunshine. Rather, Would like has a discount-browsing pushed strategy in which people today can get items that are new, exceptional, or unique at very affordable value details.

This may well have verified to be a particularly powerful chance during the pandemic when lots of specialty brick and mortar stores had been shut. In a time when Walmart (WMT) or Costco (Cost) had been the principal offered in-human being searching experiences, buying some exciting toy or jewellery item or whatnot from Want gave consumers something fascinating.

Now, nonetheless, Would like is competing with a considerably broader range of alternate purchasing possibilities. In addition, Wish’s own reliance on lower price pricing has led to significant issues around product or service high-quality. Quite a few evaluations cite issues with products and solutions that never function for extremely long or feel shoddy in design. In went further than that. As fellow Trying to find Alpha author William Sabga-Aboud pointed out, high quality fears led to France outright blocking the application in that region final slide owing to products and solutions that had been observed to be dangerous.

A large amount of ecommerce apps have run into harder operating ailments among the renewed competitiveness from bodily retailers, supply chain challenges, and mounting logistics fees. It is not unreasonable for on-line marketplaces to be viewing a slowdown in 2022.

But Wish’s drop in operating metrics is on a entire distinctive tier from its rivals. This is a enterprise that desperately requires a new business system or advertising and marketing angle or one thing to change matters all around.

Is Want A Good Very long-Time period Expense?

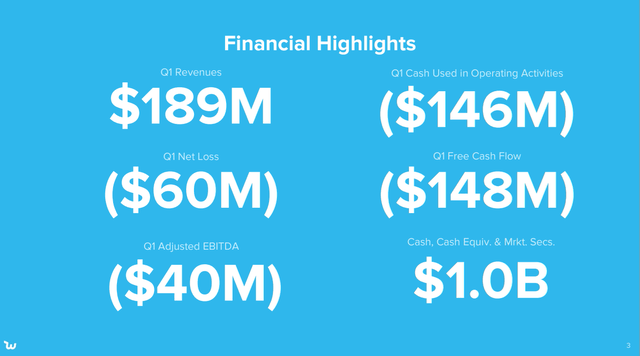

A slide from ContextLogic’s most new quarterly earnings final results puts the firm’s predicament into sharp contrast:

Desire money results (Corporate presentation)

The 1 great piece of news is that the corporation even now has $1. billion of money and marketable securities remaining. But, it managed to burn off by way of $148 million of money just previous quarter alone. Notice that the firm’s cost-free funds stream is substantially even worse than its presently sizable internet decline and unfavorable modified EBITDA.

Centered just on funds on your own, ContextLogic might seem to be like a decent speculative obtain. Just after all, the industry cap is now $1.1 billion, that means that the real functioning business is only being valued close to $100 million or so. And, as stated above, there are still once-a-year revenues in the billion greenback variety as properly. That may well look like enough to give this a shot at operating.

But, at a $150 million quarterly burn price, the firm’s dollars is probable to be exhausted by early 2024 if items continue to keep heading as they are presently. Meanwhile, any substantial turnaround would likely force the business to change marketing and advertising commit back up or normally invest in advancement initiative. ContextLogic’s endeavours to lower functioning fees in modern quarters, as we have noticed, have experienced a devastating impression on the company’s profits trajectory.

And, as also observed, it truly is a difficult operating surroundings for ecommerce providers and even big brick and mortar operators like Walmart and Target (TGT). ContextLogic is possessing to try out to execute what would previously be a complicated business enterprise turnaround less than unfavorable macroeconomic disorders.

Is Wish Stock A Purchase, Offer, Or Hold?

ContextLogic has produced some alterations. There is a new CEO. The corporation has tremendously rethought its advertising and marketing approach. And it has built some core enhancements in the app, these kinds of as getting an invite-only approach to onboarding new sellers on the platform to strengthen top quality expectations in merchandising.

ContextLogic has been capable to display some tangible signs of progress, these types of as its net promoter score “NPS” doubling because late 2021. It’s a get started.

But you can find nonetheless so a great deal to be carried out. The organization had 101 million monthly energetic buyers “MAUs” in Q1 of 2021. This collapsed to just 27 million in Q1 of 2022. It truly is really hard to overstate just how promptly or poorly this firm’s core business has eroded in new months.

Mix that with the firm’s big dollars melt away and the all round problem in this article is grim.

ContextLogic has money and it continue to has a first rate revenue base. Nevertheless, the odds of the organization getting again on track feel alternatively lower. The company’s organization product has never ever persistently developed a revenue. And now, with its brand name tarnished, the corporation has to try to provide prospects back again all when preserving expenditures in test throughout a tricky macroeconomic natural environment.

[ad_2]

Supply connection

.jpeg?width=682&height=455&name=AdobeStock_295048993%20(1).jpeg)