Is It Right for Your Business?

[ad_1]

Image source: Getty Images

If customers take longer to pay than expected and cash flow is low, you may want to consider debt factoring. Learn more about debt factoring, what it involves, and if it’s right for your business.

Every small business owner starts their business planning for success. But in business, as in life, a lot of unexpected things can happen that throw a monkey wrench into even the best-laid plans.

Things like unexpected expenses and slow-paying customers can cause cash flow to drop to dangerous lows. While more established businesses may be able to turn to more conventional solutions, such as a bank loan or line of credit, small business owners may not have access to those options.

That’s where debt factoring comes in. Using debt factoring, you can sell your accounts receivables to a debt factoring company at a discount and get a quick infusion of cash.

Overview: What is debt factoring?

If you sell to your customers on credit, you likely have uncollected accounts receivable. For small business owners that find themselves needing a quick infusion of cash, debt factoring can be a lifesaver.

In finance, factoring refers to a third party or intermediary that contracts to purchase outstanding invoices from your business. Once you find a factoring company that works in your industry, the process is fairly simple.

After filling out an application, you’re ready to sell your customer’s unpaid invoices to the factoring company, receiving 80%-85% of the value of the invoice immediately. When the customer pays the factoring company, you receive the balance of the invoice, minus the fees charged by the factoring company.

Debt factoring is different from invoice discounting, which provides your business with a short-term loan but does not purchase the invoice, leaving the invoice collection process to you.

Factoring can provide businesses with quick cash at a reasonable cost. Image source: Author

Most debt factoring companies offer both recourse and non-recourse factoring. Recourse factoring requires that your business pay the debt factoring company should a customer not pay an invoice, while in non-recourse factoring, you’re not required to repay the amount of the advance provided that the customer has a valid reason for non-payment.

Many factoring companies also offer spot factoring, which involves the sale of only select invoices to the factoring company.

Along with the completed application, you’ll have to provide the factoring company proof that you’re using acceptable accounts receivable practices in your business, which includes proper vetting of customers and timely invoicing. Providing this information should be a simple process if you’re using good accounting software.

Before signing any contract or agreement, you should understand exactly how debt factoring works, as well as the advantages and disadvantages of using a debt factoring company.

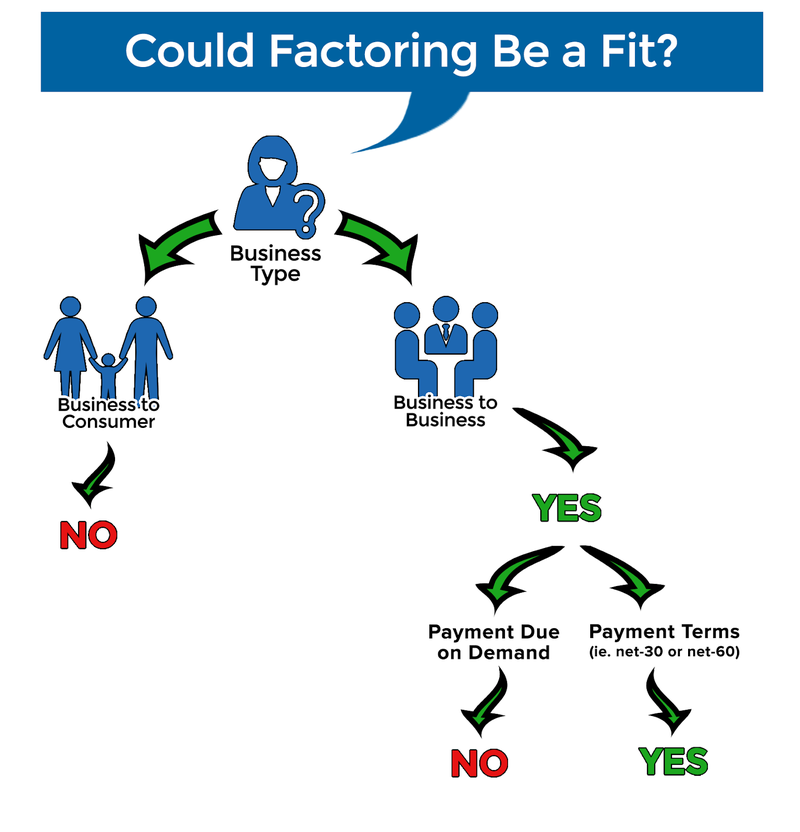

Depending on the type of business you own, factoring may not be an option. Image source: Author

Advantages of debt factoring

For small businesses, debt factoring can be a lifesaver, particularly in the early years when cash flow can be problematic. Using a debt factoring company can help with those occasional cash flow problems while also providing your company with additional capital that can be used for expanding the business or even hiring additional staff. Check out these other ways that your business can benefit from using debt factoring.

Offers quick cash

Even if your small business qualifies for a loan, chances are it can take weeks to have the cash in-hand. Debt factoring moves much faster than a traditional loan, with most businesses able to have cash in-hand in less than 48 hours. This can be particularly important if you need cash for an urgent matter such as covering payroll.

Expands your customer base

If you’ve been hesitant to offer your customers credit terms solely because of the payment turnaround time, debt factoring can help. Once you sell items to your customers on credit and the debt factoring company approves the invoice, you’ll see the payment in days, with the debt factoring company responsible for collecting the balance. This allows you to expand your customer base by offering them more favorable terms.

Possibly saves you money

Managing accounts receivable can be a full-time job. If you’re exploring the possibility of hiring an accounts receivable clerk to manage invoices, follow up with late-paying customers, and begin collection processes, you may save money by using a factoring company instead.

That’s because the debt factoring company handles all accounts receivable management once an invoice has been created, including all payment follow-up and collection, which may cost you less than the salary of a full-time accounts receivable clerk.

Disadvantages of debt factoring

As you can see, small businesses may find it advantageous to use a debt factoring company. But there are also some downsides to contracting with a factoring company that you need to be aware of.

Not an option for cash businesses

If your business is mainly selling to customers that pay immediately, debt factoring is not an option, since debt factoring involves early payment of invoices with terms of Net 30 or longer.

You still need to do a credit check on your customers

Debt factoring is not as simple as handing over customer invoices that are due. You still need to vet your customers before selling to them on credit, since debt factoring companies do not accept all invoices. If your customers don’t have good credit, odds are the factoring company will reject the invoice that you’re trying to sell.

Another reason why you’ll need to check your customer’s credit is that a slow-paying customer will cost you more money since factoring fees are calculated based on the days the invoice remains outstanding.

It can cover up business inefficiencies

If your business is chronically short of cash, debt factoring can help in the short term, but you’ll have to explore the reason why you’re not bringing in enough revenue to cover your business expenses. Are you over-staffed? Have your sales dropped? Are you paying too much rent? These are long-term problems that will need to be addressed. Using debt factoring will only provide a short-term solution.

How to find a reliable debt factoring company

There are a lot of debt factoring companies out there. How do you know which one to choose? First and foremost, you’ll want to find a reputable company that will offer you access to customer references and charges reasonable rates. If you’re not sure where to start, these suggestions may help.

1. Do some initial research

There are a lot of resources available online to help you get started in your search for a debt factoring company. Doing some initial research can help narrow your choices down. Once you do, you can start doing a deeper dive into the remaining companies, including their debt factoring experience, how long they’ve been in business, and their rates.

2. Work with a factoring broker

A factoring broker can take some of the confusion out of finding the debt factoring company that may be right for your business. A factoring broker works like an insurance or mortgage broker, searching multiple options to find the company that may be right for your business. The factoring company typically pays a commission to the factoring broker, so there is no fee to you.

3. Ask a lot of questions

Once you do find a factoring company, be sure to ask a lot of questions before signing a contract. You’ll want to get answers to the following:

- How long they’ve been in business

- What factoring options they offer

- What industries (if any) they specialize in

- What their rates are

- How quickly you can get your money

- If they require monthly minimums

Be sure you spend the necessary time to obtain the answers to all of your questions.

4. Check references

Once you do pick out a couple of debt factoring companies, make sure that you obtain references from each company and actually call those references.

Best practices when debt factoring

Once you decide to use debt factoring in your company, there are some best practices you may want to follow.

1. Pay attention to factoring activity

Don’t just turn over complete control of your accounts receivable to the debt factoring company. Stay on top of customer payment dates and don’t hesitate to bring up any questions or concerns you may have. In many cases, it can be a simple misunderstanding, but there have been cases of debt factoring companies recording payments a few days after receipt, resulting in increased fees.

2. Find a debt factoring company that works in your industry

While many debt factoring companies work with various companies, there are some industry experts. If you work in a niche field, make sure you select a debt factoring company that has experience working in your field.

3. Check out all of the fine print before signing with a company

Be sure to read all of the fine print before signing an agreement. If this is your first time using a debt factoring company, you’ll want to try to avoid a long-term contract until you are sure that the process is working favorably.

4. Look at debt factoring as a short-term solution

If your business is always short of cash, spend some time researching exactly why. While factoring debt is a great short-term solution, investigating and rectifying long-term cash flow problems is a necessity.

Debt factoring is a viable solution to temporary cash flow problems

Debt factoring can provide a good short-term solution for businesses that need a quick influx of cash. Debt factoring fees vary between companies with costs ranging from 0.5%-5% of the invoice total, making them a more affordable solution than a loan.

Before beginning invoice factoring, be sure to investigate a variety of debt factoring companies to find the perfect fit for your business.

[ad_2]

Source link

.jpeg?width=682&height=455&name=AdobeStock_295048993%20(1).jpeg)