New Mountain Finance Stock: Defensive BDC On Sale (NASDAQ:NMFC)

[ad_1]

ipopba/iStock through Getty Illustrations or photos

New Mountain Finance (NASDAQ:NMFC) is a company improvement company with a developing and well-managed portfolio, floating publicity that signifies better portfolio money as fascination prices increase, and a very low non-accrual price.

Furthermore, the organization progress enterprise addresses its dividend payments with internet financial commitment income, and the stock at present trades at a 13% lower price to guide price. The inventory is desirable to dividend buyers trying to find large recurring dividend cash flow, although NMFC’s lower valuation relative to e book value leaves home for upside.

Shopping for A 10% Generate At A Low cost

Underneath the Investment Organization Act of 1940, New Mountain Finance is categorized as a Business Progress Organization. The BDC is managed externally, which indicates it pays one more business for management services. New Mountain Finance mostly invests in center-current market organizations with EBITDA of $10 to $200 million.

The the greater part of New Mountain Finance’s investments are senior secured financial debt (1st and next lien) in industries with defensive attributes, which suggests they have a large probability of carrying out perfectly even in recessionary environments. New Mountain Finance’s core organization is middle current market financial debt investments, but the business also invests in internet lease attributes and fairness.

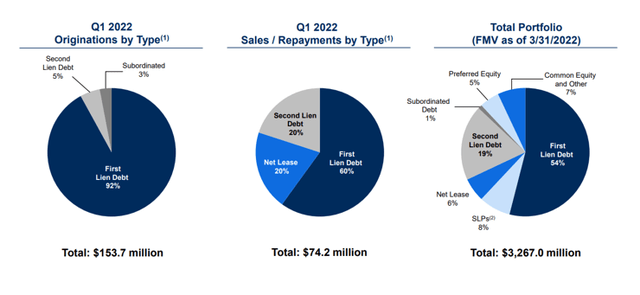

As of March 31, 2022, New Mountain Finance’s portfolio was composed of 54% 1st lien financial debt and 19% second lien debt, with the remainder spread throughout subordinated financial debt, fairness, and net lease investments. In the first quarter, virtually all new mortgage originations (92%) have been to start with lien credit card debt.

The complete publicity of New Mountain Finance to secured to start with and second lien personal debt was 73%. As of March 31, 2022, the company’s whole portfolio, which include all personal debt and equity investments, was $3.27 billion.

Portfolio Summary (New Mountain Finance Corp)

Interest Charge Exposure

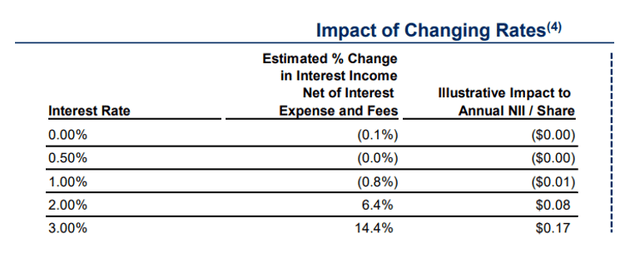

New Mountain Finance has taken care to invest largely in floating fee credit card debt, which ensures the financial investment company a financial loan amount reset if the central financial institution raises desire rates. The central bank raised interest fees by 75 basis details in June to beat climbing inflation, which strike a 4-10 years higher of 8.6% in Could. An improve in benchmark desire costs is expected to end result in a major maximize in internet curiosity revenue for the BDC.

Impact Of Changing Charges (New Mountain Finance Corp)

Credit history Effectiveness

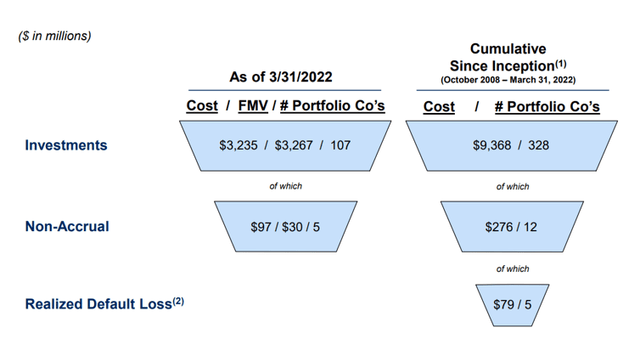

The credit rating effectiveness of New Mountain Finance is exceptional. As of March, 5 of 107 companies had been non-accrual, representing a $30 million honest worth exposure. Since the BDC’s whole portfolio was worth $3.27 billion in March, the non-accrual ratio was .9%, and the enterprise has yet to realize a loss on people investments.

Non-Accrual Ratio (New Mountain Finance Corp)

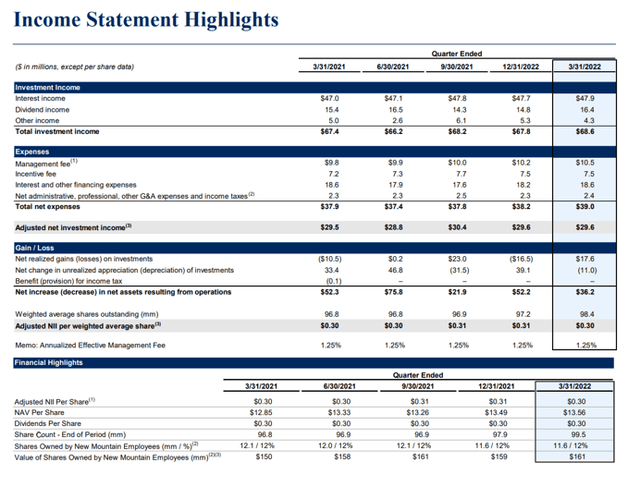

NII Addresses $.30 Per Share Quarterly Dividend Pay-Out

New Mountain Finance’s dividend of $.30 for each share is included by altered internet investment profits. In the prior calendar year, New Mountain Finance had a fork out-out ratio of 98.4%, indicating that it has consistently coated its dividend with the cash flow produced by its mortgage investments.

Even while New Mountain Finance presently handles its dividend with NII, a deterioration in credit history high-quality (bank loan losses) could lead to the BDC to under-get paid its dividend at some level in the foreseeable future.

Revenue Assertion Highlights (New Mountain Finance Corp)

P/B-A number of

On March 31, 2022, New Mountain Finance’s reserve price was $13.56, while its stock cost was $11.84. This implies that New Mountain Finance’s financial investment portfolio can be bought at a 13% price reduction to guide value.

In new months, BDCs have started to trade at larger reductions to guide worth, owing to fears about growing interest fees and the likelihood of a recession in the United States.

Why New Mountain Finance Could See A Decreased Valuation

Credit rating quality and book price tendencies in business improvement companies show buyers regardless of whether they are dealing with a trusted or untrustworthy BDC. Companies that report lousy credit score high-quality and book price losses are usually compelled to lessen their dividends. In a downturn, these BDCs really should be avoided.

The credit history good quality of New Mountain Finance is robust, as calculated by the level of non-accruals in the portfolio. Credit score high-quality deterioration and guide value losses are chance things for New Mountain Finance.

My Summary

New Mountain Finance is a effectively-managed and economical business enterprise growth firm to invest in.

Presently, the stock rate is decreased than the NMFC’s reserve value, implying that the BDC can be bought at a 13% discount to book price.

In addition, New Mountain Finance’s overall credit score good quality seems to be favorable, and the small business improvement business covers its dividend payments with internet expenditure money.

[ad_2]

Source backlink

.jpeg?width=682&height=455&name=AdobeStock_295048993%20(1).jpeg)