The Good Business Portfolio: 2022 1st Quarter Portfolio Review

[ad_1]

Fabrice Cabaud

This article reviews the 2022 first-quarter earnings and 2022 YTD performance of The Good Business Portfolio (My IRA portfolio). So far, this year is a bad year, down 18%: 4% below the Dow average. Good companies are coming back as their workforce returns. Earnings data for some of the top positions in the portfolio and recent changes to the portfolio are included in the earnings and company comments section. At present, it looks like the Republicans will take control of Congress, allowing them to reverse some of the economic policies of the present administration, giving the market an up movement.

Guidelines (Company selection)

The Good Business Portfolio guidelines are used to create a portfolio that is a large-cap balanced portfolio between the different styles of investing. Income investors take too much risk to get their high yields. Bottom-fishing investors get catfish. Value investors have to have the foresight to see the future.

Over many years, I have codified 11 guidelines for company selection. These are guidelines and are not rules. For a complete set of guidelines, please see my article, “The Good Business Portfolio: Update to Guidelines, March 2020.” They are meant to be used as filters to get to a few companies on which further analysis is done before adding them to the portfolio. So, it’s all right to break a guideline if the other guidelines indicate a Good Company Business. I’m sure this eliminates some really good companies, but it gets me a shortlist to review. There are too many companies to even look at 10% of them.

You see from the portfolio below that I want a defensive portfolio that provides income and does not take significant risks. I limit the portfolio to 25 companies, as more than this is almost impossible to follow. I have 21 companies in the portfolio, so the portfolio has four open slots.

Portfolio Performance

The performance of the portfolio created by the guidelines has, in most years, beat the Dow average for over 30 years, giving me steady retirement income and growth. The table below shows the portfolio performance for 2012 through 2021 and 2022 YTD. The chart data is after the close on June 24, 2022.

|

Year |

DOW Gain/Loss |

Good Business |

Beat Difference |

|

Portfolio |

|||

|

2,012 |

8.70% |

16.92% |

8.22% |

|

2,013 |

27.00% |

39.70% |

12.70% |

|

2,014 |

6.04% |

8.67% |

2.63% |

|

2,015 |

-2.29% |

5.68% |

7.97% |

|

2,016 |

13.38% |

8.68% |

-4.70% |

|

2,017 |

25.10% |

21.28% |

-3.82% |

|

2,018 |

-5.63% |

-4.33% |

1.30% |

|

2,019 |

22.33% |

24.19% |

1.86% |

|

2,020 |

7.25% |

10.72% |

3.47% |

|

2,021 |

18.73% |

19.49% |

0.76% |

|

2022 YTD |

-14.42% |

-18.42% |

-4.00% |

In a great year like 2013, the portfolio did fantastically. In a normal year like 2014, it beat the Dow by a fair amount. So far this year, the portfolio is behind the Dow by 4% total return below the Dow average loss of 14.42%, for a total portfolio loss of -18.42%, which is not good, with six months to go in the year and earnings increasing for the portfolio companies there is the hope of a recovery in November.

Boeing (BA) and General Electric (GE) have begun to recover some as the 787 is flying again, but BA missed expected earnings for the last quarter; these two companies have been holding back the portfolio. This quarter we have another company that cut its earnings by 10%, and that is Disney (DIS). Disney has a great pipeline, and with the theme parks opening again, it should recover nicely within a year. The other good business companies are doing well, beating company earnings estimates, with Home Depot (HD), Johnson & Johnson (JNJ), and Texas Instruments (TXN) leading the pack.

Fundamentals will continue to shine this year and for years to come for the portfolio of good businesses to return to normal as the COVID virus continues to be controlled by the present vaccines, with a new vaccine expected by the fall tailored to the present dominant strain of the COVID virus.

Companies in the Portfolio

The 21 companies and their percentage in the portfolio and total return over a 77-month test (starting January 1, 2016, to 2022 YTD) period are shown in the table below. This time frame was chosen since it included the great years of 2017, 2019, and the average year of 2020 with other years that had a fair and bad performance. The Dow baseline for this period is 75.53%, and 14 of the positions beat or matched that baseline.

There are seven companies that missed the Dow baseline by more than 10% but are still great businesses and will come back as the United States economy grows and the COVID virus is further controlled. I limit the portfolio to 25 companies and generally let the winners grow until they reach 8%-9% of the portfolio, and then I trim the position. The two companies in trim position are Home Depot at 10.57% of the portfolio and Johnson & Johnson at 10.38% of the portfolio. I will be trimming HD and JNJ down to 10% of the portfolio to maintain diversification.

What do you think is a good percentage for the maximum of any one position in a portfolio? I would be interested to hear your comments. I also have to sell at least 2% of my portfolio to cover my RMD for the year, and in a down year so far, this gives me very hard decisions.

|

DOW Baseline |

75.53% |

|||

|

Company |

Total Return |

Difference |

Percentage of Portfolio |

Cumulative Total |

|

77 Months |

From Baseline |

Percentage of Portfolio |

||

|

Home Depot (HD) |

148.45% |

72.92% |

10.57% |

10.57% |

|

Johnson & Johnson (JNJ) |

104.24% |

28.71% |

10.38% |

20.95% |

|

Eaton Vance Enhanced Equity Income Fund II (EOS) |

81.56% |

6.03% |

7.07% |

28.02% |

|

Walt Disney (DIS) |

18.12% |

-57.41% |

5.34% |

33.35% |

|

Texas Instruments (TXN) |

235.48% |

159.95% |

7.56% |

40.91% |

|

Automatic Data Processing (ADP) |

204.14% |

128.61% |

8.64% |

49.55% |

|

Trane (TT) |

234.18% |

158.64% |

5.80% |

55.35% |

|

Boeing (BA) |

44.45% |

-31.09% |

5.00% |

60.35% |

|

McDonald’s Corp. (MCD) |

141.11% |

65.58% |

7.89% |

68.24% |

|

Omega Health Inv. (OHI) |

25.29% |

-50.24% |

6.33% |

74.57% |

|

Altria Group Inc. (MO) |

9.20% |

-66.33% |

4.48% |

79.05% |

|

Philip Morris INTL INC. (PM) |

51.10% |

-24.43% |

5.46% |

84.51% |

|

Digital Realty Trust (DLR) |

113.96% |

38.43% |

4.37% |

88.88% |

|

Freeport McMoRan (FCX) |

424.53% |

349.00% |

3.90% |

92.78% |

|

General Electric (GE) |

-70.84% |

-146.37% |

1.25% |

94.03% |

|

Danaher Corp. (DHR) |

284.07% |

208.54% |

1.62% |

95.65% |

|

American Tower (AMT) |

207.92% |

132.39% |

1.10% |

96.75% |

|

Realty Income (O) |

60.56% |

-14.97% |

0.79% |

97.54% |

|

Lockheed Martin (LMT) |

123.91% |

48.38% |

0.88% |

98.42% |

|

Visa (V) |

181.86% |

106.32% |

0.43% |

98.85% |

|

PepsiCo (PEP) |

95.60% |

20.06% |

0.79% |

99.64% |

|

Average Above Dow |

53.94% |

Therefore, JNJ and Home Depot are now in a trim position, but I am letting JNJ run a bit to 10% of the portfolio since it is a great defensive medical supply business. I start the companies at a base percentage of the portfolio of close to 1% and add to the position if they perform well during the next six months. At 4% of the portfolio, I stop buying and let the company percentage of the portfolio grow until it hits 8%; then, it is time to consider trimming (reducing position by 0.5% of the portfolio) the position.

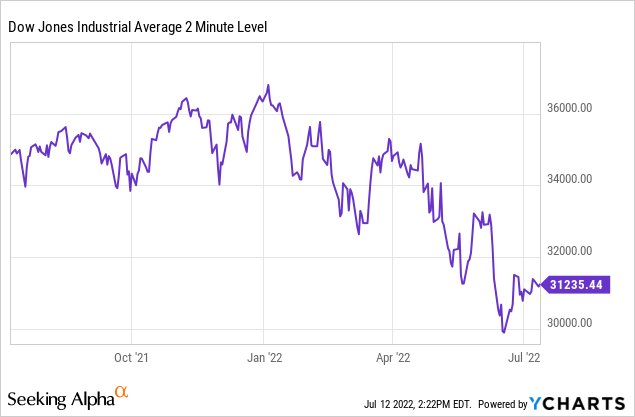

The graphic below shows the Dow average for the past five years, a good chart with nice gains as the United States economy was growing again until the war on fossil fuels was started. I have one question, what powers aircraft without fossil fuels, and where does the electricity come from to power all the electric cars?

The above is the full list of my 21 Good Business positions. I have written individual articles on all these businesses.

Earnings and Company Comments

For the first-quarter earnings season, the 21 portfolio companies did very well, considering the conditions created by the virus. Nineteen companies beat or met earnings estimates and two below estimates (BA, DIS). The good businesses are holding up well, and many have had increases in their target prices. Now on to some of the companies that beat earnings and two that missed earnings.

On 5/17/2022, Home Depot earnings were expected at $3.86 and came in at $4.09 and compared to last year at $3.86, a great quarter Y/Y. Revenue beat compared with expected by $2.3 billion. Total revenue was $38.91 billion, up 3.8% Y/Y. HD had a great report, showing growth even in this pandemic environment. HD will be trimmed to 10% of the portfolio to maintain diversification. HD is a great business, but it must start to expand its foreign business to get good growth going forward. They held up well during the COVID-19 virus slow down, and the company is a solid investment long term. S&P CFRA lowed their price target on HD to $375. Home Depot is a buy as the market dip gives us a buying opportunity at a low bargain price and a 39% increase to the target.

A SWAN-type (sleep well at night) company I have in the portfolio is JNJ, with 60 years of dividend increases. On 4/19/22, Johnson & Johnson’s earnings were above expected at $2.67 compared to last year at $2.59 and expected at $2.57. Revenue beat expected revenue by $210 million, with total revenue up 4.8% at $23.4 Billion. They are still growing and have plenty of cash to buy companies and continue their growth. JNJ will be pressed to 10% of the portfolio because they’re so defensive in this COVID-19 Virus world. The JNJ’s one-shot vaccine is shipping across the United States and foreign countries. JNJ is not a trading stock but a hold forever a SWAN. If you want a hold forever top-notch medical supply company with a growing 2.6% dividend (60 years of increases), JNJ is a buy.

An interesting company I have as an income producer is Omega Healthcare (OHI), a REIT in the nursing home business. They are good at managing the selling and buying of nursing home properties. The COVID virus has hurt OHI for the last two years, and the dividend increases have stopped because the virus is hurting their business. The company’s last quarter’s earnings, released on May 2, were fair at $0.74 FFO, beating expected by $0.04 and compared to last year at $0.85. The dividend is $0.67/Qtr. and may suffer a cut if the operators that are in trouble cannot pay the rent.

OHI has taken steps to fix the losing operators by selling properties, moving properties, or changing the rental agreement. OHI has been there before and has shown they can fix this problem but may need a few more quarters. For me, OHI is a buy as the COVID virus is controlled in their business, and the senior citizen population will grow for many years as you collect a 9% yield. The vaccination rate in nursing homes is high, but there is always the possibility that a new strain of COVID could hit. I think the pressure of COVID presents a buying opportunity to buy an income company at a fair price in a growing business for the investor that has patience and can take the risk.

One company position that did not meet expected earnings is DIS. On May 11, Disney reported earnings of $1.08 compared to expected earnings of $1.19 with revenues at $19.24 billion, up 23.3%, and missed expected revenues by $800 million. This was a bad report, and Mr. Market took Disney for a ride down. The Disney+ subs are increasing but not at the rate expected. They are expanding in other parts of the world that will increase the subs next year. The theme parks are now open, and with the vertical integration to drive profits of the Marvel and Star Wars names, how can you go wrong. I feel this is an opportunity to buy DIS at a bargain price. I will hold my position since I already have a full position of 5.34% of the portfolio.

Boeing is having the worst spell of incidents in many years between the COVID dip and problems with the 737 and 787 planes. Boeing has dropped from over $400 to around $140. It’s hard to believe that just about 2.5 years ago, I sold some BA at over $400. My position now is a buy as we watch the great Boeing business return to normal over the next two years as the pilots start to return and airlines need new planes. The 787 has started shipping and should really help the bottom line. On 4/27, Boeing earnings were -$2.75, well below the expected of -$0.25, and revenue was down 8% YOY at $13.99 billion. The commercial business is on the mend giving a value play on a great business at a bargain price.

Portfolio Management Comments

I did not sell during the COVID decline and watched the market recover as the United States economy started to grow again. The good businesses in my portfolio have gone up with the latest increase in the economy and excellent reported earnings of the portfolio companies, and I expect it to continue for the rest of the year 2022 and into 2023.

The market has recovered from the COVID-19 virus dip, with the future looking good with people returning to work and school. We now have three vaccines that allow the United States to have a vaccine shot for all who want it. The big pharma companies are developing a vaccine tailored to the BA.4 and BA.5 strain that is presently spreading around the world. This vaccine is expected to be ready by August for this winter’s COVID season. As herd immunity starts, the spread of the virus will strongly decrease, allowing workers to go back to work and schools to open fully, which has started as shown by the labor increase in jobs each month. Each quarter after the earnings season, I write an article giving a complete portfolio list and performance like this article.

Conclusion

The 11 guidelines referenced in the article give me a balanced portfolio of good companies that are large-cap and can grow their revenues, earnings, and dividends for years. They have the staying power to fix whatever goes wrong. In each case, the company has the size and good management to fix the problem. The portfolio has growth companies, defensive companies, income companies, and companies with international exposure, giving it what I call balance. Of the 21 companies in the portfolio, seven are underperforming the Dow average in total return by more than 10% over my 77-month test period.

The portfolio is 4% lower than the Dow average YTD, with increases in earnings expected in the second quarter for almost all the portfolio companies. I intend to continue writing separate comparison articles on individual companies. I have written articles on all of the companies in the portfolio and others, and you can read them in my list of previous articles if you are interested. If you would like me to do a review of a company you like, please comment, and I will try to do it.

[ad_2]

Source link

.jpeg?width=682&height=455&name=AdobeStock_295048993%20(1).jpeg)